PROJECTS

Khnaiguiyah Zinc-Copper Project

The Khnaiguiyah zinc-copper project location

The Khnaiguiyah zinc-copper project, located 170 kilometres southwest of Riyadh, is the Kingdom’s largest mine exploration site, covering approximately 354 km². It forms part of the Arabian Shield, which is known to have 35 mineralised belts that host deposits and occurrences of gold, zinc, copper, nickel and other metals.

According to the Saudi Ministry of Industry and Mineral Resources and based on data from the Saudi Geological Survey, the Khnaiguiyah zinc-copper project has ore reserves of around 25 million tonnes, with grades of 4.11% zinc and 0.56% copper, and has the capability to produce 55,000 tonnes per annum of ore concentrates over a period of 12 years.

In 2022, the Ministry of Industry and Mineral Resources, in Saudi Arabia’s drive to seek new mining investors as part of the Vision 2030 plan, put the exploration rights to the Khnaiguiyah project, consisting of four inter-conditional exploration licences across the site, up for auction. The Khnaiguiyah project is considered critical to developing the Kingdom's zinc and copper downstream industries.

The exploration rights to the Khnaiguiyah zinc-copper project are valid for a period of up to 15 years in total with a maximum five-year initial term, plus one or more renewal periods of not more than five years each. Exploitation licences in Saudi Arabia are typically issued with a duration limitation of 60 years (inclusive of renewals and/or extensions), with an initial term of up to 30 years.

Moxico formed a 50:50 owned consortium with Ajlan Bros & Holding Company to bid for the mineral rights to the Khnaiguiyah project. Six bidders made detailed submissions, following which the Ministry of Industry and Mineral Resources of Saudi Arabia invited the top three bidders only to participate in a multi-round auction. The multi-round auction process was streamed live on YouTube in order to maintain transparency and ensure a completely unbiased process. In September 2022, Saudi Arabia’s Ministry of Industry and Mineral Resources announced that the UK-Saudi consortium of Moxico and Ajlan emerged as the winner of the auction process.

Representatives of the Ajlan and Moxico joint venture company at the Future Minerals Forum in Riyadh in 2023

On 11 January 2023, a ceremony was held in Riyadh in the Kingdom of Saudi Arabia at the Future Minerals Forum during which the mineral rights to the Khnaiguiyah project were formally handed over by the Government of Saudi Arabia to Moxico and Ajlan.

The Khnaiguiyah zinc-copper project has previously had advanced evaluation work undertaken on it, including a definitive feasibility study, covering 100,000 metres drilled and a 3D geological model.

Moxico and Ajlan undertook its own bankable feasibility study for the development of the Khnaiguiyah project. The work commenced in early 2023 and the study was completed during the second quarter of 2024.

The bankable feasibility study shows a technically and economically attractive project, producing zinc metal in concentrate at a peak mining production rate of 130,000 tonnes per annum, which is planned to stabilise at 105,000 tonnes per annum.

In addition, copper metal in concentrate is planned at a peak production rate in excess of 10,000 tonnes per annum, which is planned to stabilise at 6,500 tonnes per annum.

The final investment decision is targeted for the first half of 2025. Construction is expected to start shortly thereafter and be completed within a period of two years.

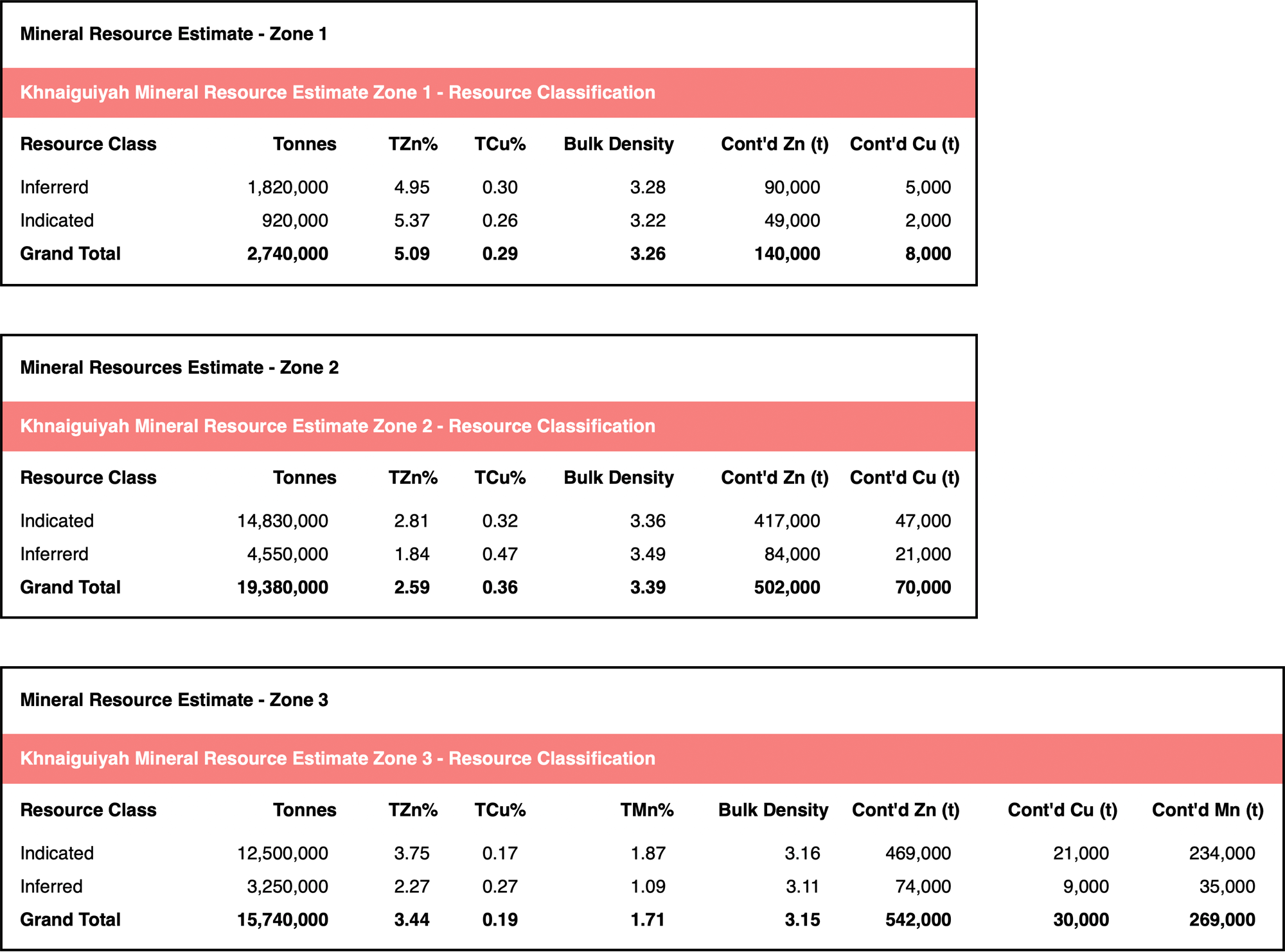

The Khnaiguiyah project bankable feasibility study includes a mineral resource estimate for zinc and copper of 37.86 million tonnes at 3.12% zinc and 0.28% copper equivalent to 1.18 million tonnes of zinc metal and 107,620 tonnes of copper metal.

Resource development exploration plans are expected to increase the currently known orebodies to over 50 million tonnes, resulting in a 13-year life-of-mine.

Brownfields and greenfields exploration programmes are also in the planning. It is anticipated these will increase the estimated resource to a target of 100 million tonnes, thereby extending the life-of-mine beyond 24 years.

A manganese deposit has also been identified within the licence area and potential for early exploitation is being advanced through a 450,000 tonnes per annum dense medium separation plant producing 65,000 tonnes per annum of manganese metal in concentrate at 37% manganese. First production of manganese is currently expected to occur in the first quarter of 2025. The bankable feasibility study includes a resource estimate for manganese of 5.38 million tonnes with 1.56 million tonnes at 10% manganese and 3.82 million tonnes at 5% manganese.

A pre-feasibility study for smelting zinc concentrate from the Khnaiguiyah project at a zinc smelting facility to be established in Saudi Arabia was completed in the first quarter of 2024. A bankable feasibility study for the construction of a 200,000 tonnes per annum zinc refinery and smelter is expected to commence in early 2025. By-product production of sulphuric acid, copper metal and silver metal will form part of the scope of the bankable feasibility study. The zinc smelter will provide further options for very significant value creation. It will process material from the Khnaiguiyah project, zinc concentrate from Saudi Arabia and imported zinc concentrate from outside the Kingdom.

With the very good orebody of the Khnaiguiyah project and financial support from the Kingdom of Saudi Arabia for exploration, development and production, Moxico and Ajlan are optimistic that the project can generate high financial returns.